Adaptive Payments API: Getting Started

Full source code is available here

This guide presents the following sections to quickly get you up and running with

the Adaptive Payments API:

Overview

The Adaptive Payments API enables merchants and developers to select the payment

scenario most suitable to their needs. Merchants and developers can create applications

that manage payments, payment preapprovals, and refunds. Merchants and developers

can also send money peer-to-peer, split payments in both parallel and chained models,

accept guest payments,

, and schedule disbursements. It works on multiple platforms including the web and

mobile environments.

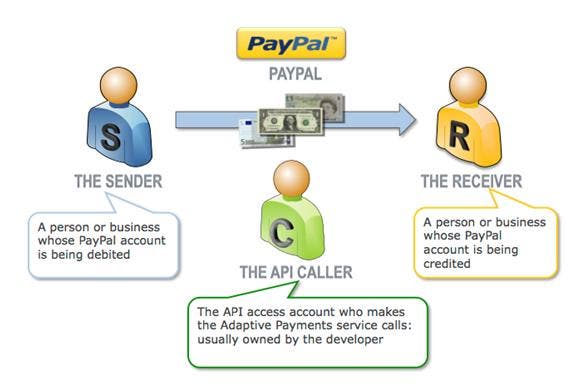

Key Concepts

Adaptive Payments has operations that enable the sending and receiving of payments

involving two or more parties. Each Adaptive Payments API transaction includes a

sender and one or more receivers of the payment. Each transaction also includes

the application owner, called the "API Caller," who is an invisible third

party that provides the transaction flow and is the entity that makes the API calls.

In most scenarios, payment transactions are initiated by the buyer (in asend type

of payment arrangement) or by the seller (in a pay type of payment

arrangement).

Figure 1. Overview of Adaptive Payments

The Adaptive Payments API uses the

Pay operation

to make payments between a sender and one or more receivers of that payment. Payments

can be split between receivers (in either "chained" or "parallel"

modes) and additional operations in the API lets senders authorize and preapprove

an application to make payments on their behalf. The flexibility of the operations

in the API make for an "adaptive" set of functions that addresses a wide

range of payment scenarios.Payment Approvals

As with any payment, the payments made via the Adaptive Payments API must be authorized

and approved by the payment sender. To provide the best possible user experience

for senders, the Adaptive Payments API provides the following payment approval methods:

- Web Redirect

- The default method where applications redirect the sender of the payment to PayPal for approval.

- Embedded Process

- Applications embed the payment authorization process into the application itself.

- Implicit

- Applications act as the sender of the payment and implicitly authorize the payment.

- Preapproved

- Applications obtain a preapproval from the sender.

Making Your First Call

To make a call to the Adaptive Payments

Pay operation,

supply the necessary HTTP headers and call payload to the service

endpoint.

A call to the

Pay operation

involves three users:- API Caller, represents your application and the account whose credentials the application uses to make the call

- Sender, the account making the payment

- Receiver, the account receiving the payment

The following steps outline the inputs needed to make the call and shows how to

authorize the payment after the

Pay operation

succeeds:- Obtain the endpoint for the service and environment you are addressing.

The Sandbox endpoint for the Adaptive PaymentsPayoperation is:https://svcs.sandbox.paypal.com/AdaptivePayments/Pay

- Format the HTTP headers needed to make the call.

You need to supply the following headers to call thePayoperation:// Sandbox API credentials for the API Caller account X-PAYPAL-SECURITY-USERID : Sandbox-Caller-User-Id X-PAYPAL-SECURITY-PASSWORD : Sandbox-Caller-Password X-PAYPAL-SECURITY-SIGNATURE : Sandbox-Caller-Security-Signature // Global Sandbox Application ID X-PAYPAL-APPLICATION-ID : APP-80W284485P519543T // Input and output formats X-PAYPAL-REQUEST-DATA-FORMAT : JSON X-PAYPAL-RESPONSE-DATA-FORMAT : JSON

- Format the call payload.

ThePayoperation requires several payload input fields, shown here as a JSON object: - Make the call.

- If your

Paycall is successful (theackfield in the response containsSuccess), redirect the Sender to PayPal so they can authorize the payment:- Retrieve the

payKeyvalue from the response of thePaycall.Here is an example of a successfulPayresponse with thepayKeyhighlighted:{ "responseEnvelope": { "timestamp": "2011-08-20T15:12:20.833-07:00", // GMT time that the server issued the response "ack": "Success", // Status of the response "correlationId": "nnnnnnnnnnnn", // ID identifying the response "build": "nnnnnnn" // Version of the server }, "payKey": "Your-payKey", // Key used to authorize payment "paymentExecStatus": "CREATED" // Current status of payment } - Use the

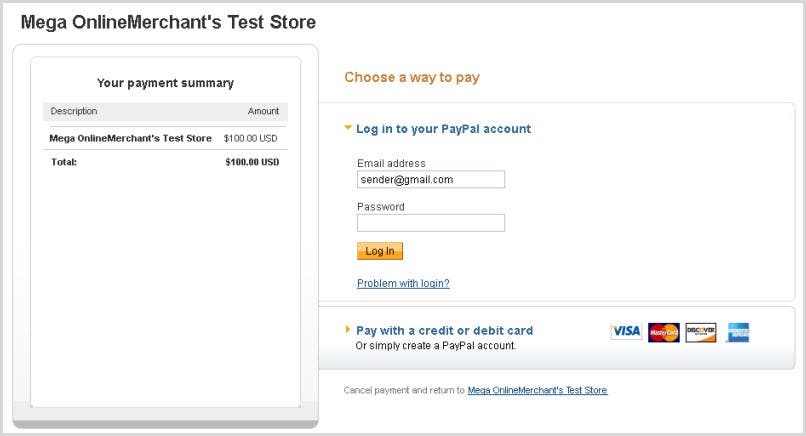

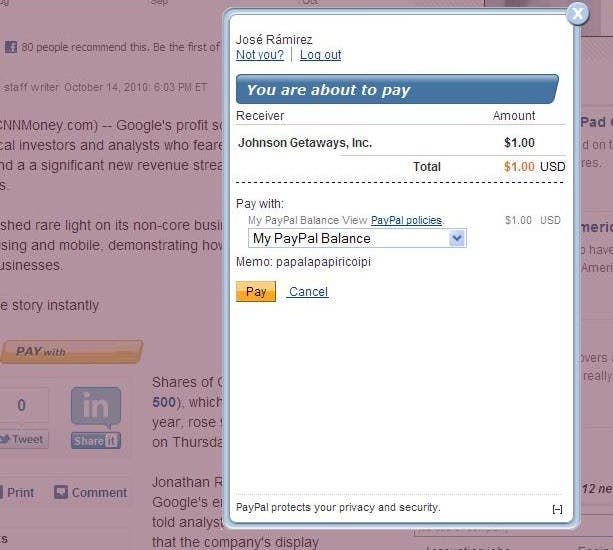

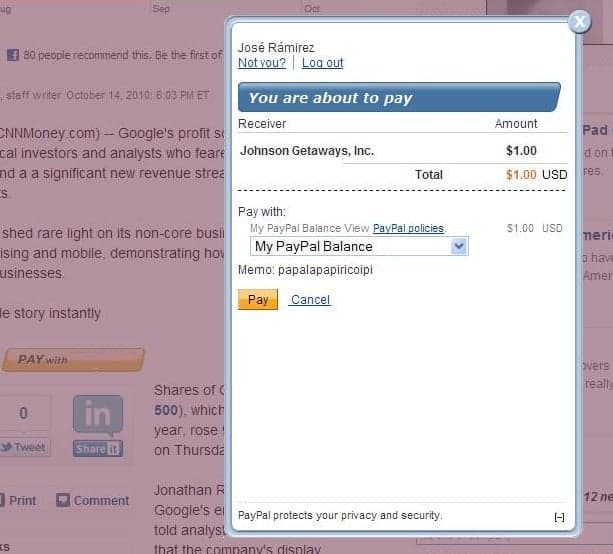

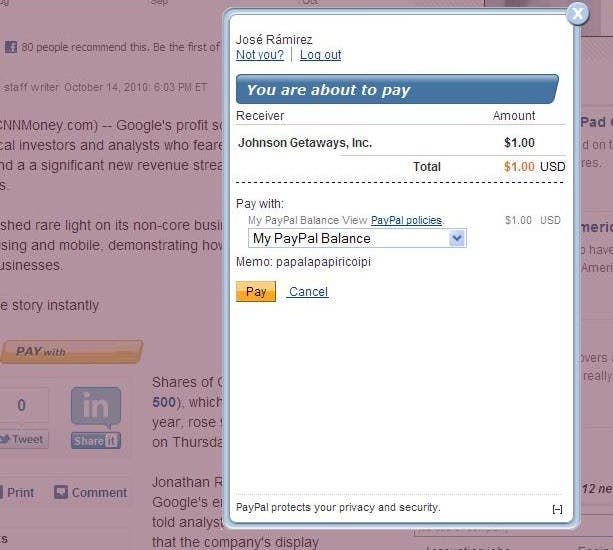

payKeyvalue in an authorization redirect to PayPal using the following Sandbox URI:https://www.sandbox.paypal.com/cgi-bin/webscr?cmd=_ap-payment&paykey= Your-payKeyWhen redirected to PayPal, the Sender is presented with a PayPal Authorization window where they can login to their account and approve the payment.

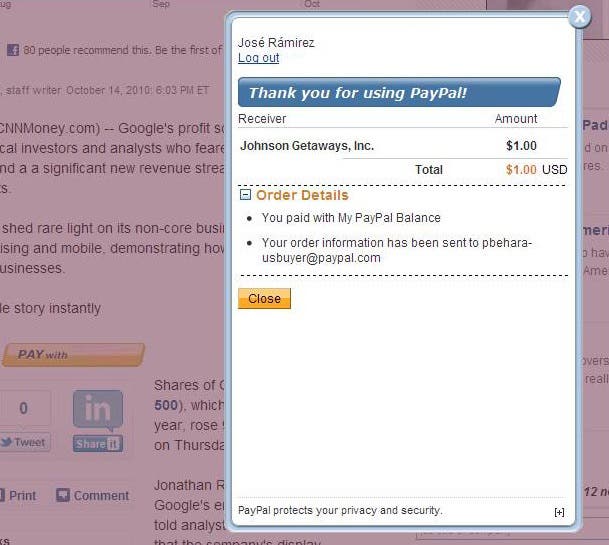

Figure 2. Authorizing the Payment

- Retrieve the

{

"actionType":"PAY", // Specify the payment

action

"currencyCode":"USD", // The currency of the

payment

"receiverList":{"receiver":[{

"amount":"1.00", // The payment

amount

"email":"Sandbox-Receiver-eMail"}] //

The payment Receiver's email address

},

// Where the Sender is redirected to after approving a successful

payment

"returnUrl":"http://Payment-Success-URL",

// Where the Sender is redirected to upon a canceled payment

"cancelUrl":"http://Payment-Cancel-URL",

"requestEnvelope":{

"errorLanguage":"en_US", // Language used

to display errors

"detailLevel":"ReturnAll" // Error detail

level

}

}

That's it, you're now set to make the call.

Once the buyer authorizes the payment, the transaction is complete and they are

redirected to the URL specified by the

returnUrl input

field in your Payrequest.Try It!

The following cURL command contains a call to the

Pay operation.

Run the command by copying and pasting it into a code window. (If cURL is not installed

on your system, you can download the free cURL executable from http://curl.haxx.se/download.html.)curl -s --insecure -H "X-PAYPAL-SECURITY-USERID: caller_1312486258_biz_api1.gmail.com" -H "X-PAYPAL-SECURITY-PASSWORD: 1312486294" -H "X-PAYPAL-SECURITY-SIGNATURE: AbtI7HV1xB428VygBUcIhARzxch4AL65.T18CTeylixNNxDZUu0iO87e" -H "X-PAYPAL-REQUEST-DATA-FORMAT: JSON" -H "X-PAYPAL-RESPONSE-DATA-FORMAT: JSON" -H "X-PAYPAL-APPLICATION-ID: APP-80W284485P519543T" https://svcs.sandbox.paypal.com/AdaptivePayments/Pay -d "{\"actionType\":\"PAY\", \"currencyCode\":\"USD\", \"receiverList\":{\"receiver\":[{\"amount\":\"1.00\",\"email\":\"rec1_1312486368_biz@gmail.com\"}]}, \"returnUrl\":\"http://www.example.com/success.html\", \"cancelUrl\":\"http://www.example.com/failure.html\", \"requestEnvelope\":{\"errorLanguage\":\"en_US\", \"detailLevel\":\"ReturnAll\"}}"

Voilà! You have made your first call to the Adaptive

Payments API.

After issuing the command, the Adaptive Payments service should return a successful

response that includes a valid Sandbox

payKey.

The above call is made possible by the use of a publicly-available set of Sandbox

credentials (highlighted in the call). While you can extract the

payKey from

the response and use it in an authorization redirect, you will be unable to authorize

the Sandbox transaction. However, if you substitute the credentials and e-mail address

from your Sandbox test accounts into the above command, you will be able to complete

the entire transaction flow in the Sandbox.

If, after using your own Sandbox credentials, your

Pay call

is not successful, review the call response for the error details and address the

problem before resubmitting the call. If your call is successful, insert the returned payKey value

into the following URL:https://www.sandbox.paypal.com/cgi-bin/webscr?cmd=_ap-payment&paykey=payKey

Log in to the resulting PayPal window with your Sandbox Buyer account to complete

the transaction. Once complete, log into your Sandbox account and review the test

account balances and e-mail to see the transaction results.

Introducing Adaptive Payments

The Adaptive Payments API enables you to send money in many different scenarios,

from simple to complex. For example, you might build a small send money application

for a social networking site or a robust payroll system.

Adaptive Payments Actors and Objects

Adaptive payments handles payments between a sender of a payment

and one or more receivers of the payment. You are an application

owner, such as a merchant that owns a website, the owner of a widget on

a social networking site, the provider of a payment application on mobile phones,

and so on. Your application is the caller of Adaptive Payments API operations.

Note: The application owner must have a PayPal Business account.

Senders and receivers can have any PayPal account type. Senders and receivers are

not required to have PayPal accounts initially. PayPal prompts a sender to create

an account before a payment can be completed. A receiver must create an account

to receive the funds after the payment completes.

With many applications, you may be both the application owner and a receiver. For

example, as the owner of a website, you are the receiver of payments from the senders

who are your customers. The following diagram shows the relationship between a sender,

you as a receiver, and PayPal:

You are not required to be a receiver. For example, if you own a shopping cart,

you are not required to receive payments directly. You can facilitate payments between

the sender and receivers that provide the actual goods. The following diagram shows

the relationship between a sender, you as an application owner that directs payments

to receivers, and PayPal:

This diagram shows a payment in which the sender pays multiple receivers in a parallel

payment. With parallel payments, the sender can see the transaction to each receiver.

The following diagram shows the relationship between a sender, you as an application

owner that directs payments to receivers, and PayPal in a chained payment:

In a chained payment, the sender pays the primary receiver an amount, from which

the primary receiver pays secondary receivers. The sender only knows about the primary

receiver, not the secondary receivers. The secondary receivers only know about the

primary receiver, not the sender.

The following diagram shows the relationship between you as both the sender and

the application owner that directs payments to receivers:

For example, you might use this configuration in a sales commission application

that transfers funds owed for commissions from your account to the accounts of your

sales force.

Simple, Parallel, and Chained Payments

Adaptive Payments provides several kinds of payment: simple, parallel, and chained

payments. You create each kind of payment with the Pay API.

-

Simple payments enable a sender to send a single payment to a single receiver. For

example, your website can use an Adaptive Payments payment flow to transfer money

resulting from a sale from your customer's PayPal account to your own account. This

is the traditional kind of payment.

-

Parallel payments enable a sender to send a single payment to multiple receivers.

For example, your application might be a shopping cart that enables a buyer to pay

for items from several merchants with one payment. Your shopping cart allocates

the payment to merchants that actually provided the items. PayPal then deducts money

from the sender's account and deposits it in the receivers' accounts.

-

Chained payments enable a sender to send a single payment to a primary receiver.

The primary receiver keeps part of the payment and pays secondary receivers the

remainder. For example, your application could be an online travel agency that handles

bookings for airfare, hotel reservations, and car rentals. The sender sees only

you as the primary receiver. You allocate the payment for your commission and the

actual cost of services provided by other receivers. PayPal then deducts money from

the sender's account and deposits it in both your account and the secondary receivers'

accounts.

Note: Chained payments also include delayed chained payments,

in which payments to secondary receivers can be delayed for up to 90 days.

Pay API.

Note: Chained payments also include delayed chained payments,

in which payments to secondary receivers can be delayed for up to 90 days.

Simple Payments

Simple payments enable a sender to send a single payment to a single receiver. This

is sometimes considered a traditional payment, such as a payment from a buyer to

a seller.

Scenarios involving simple payments might include the following scenarios:

- Buyer makes a payment on a merchant's website.

- Buyer makes a single payment for a cart of items from the same merchant.

- Person on a social networking site makes a payment for a purchase to the receiver.

For example, a sender sends money to pay for lunch at a restaurant.

In these cases, the sender sends a payment to a single receiver. The following example

shows a sender making a simple payment:

Parallel Payments

A parallel payment is a payment from a sender that is split directly among 2-6 receivers.

Technically, a parallel payment is a set of multiple payments made in a single Pay request.

Parallel payments are useful in cases when a buyer intends to make a single payment

for items from multiple sellers. Examples include the following scenarios:

- a single payment for multiple items from different merchants, such as a combination

of items in your inventory and items that partners drop ship for you.

- purchases of items related to an event, such as a trip that requires airfare, car

rental, and a hotel booking.

In these cases, the sender knows the receivers and the amount paid to each one.

The following example shows a sender paying 3 receivers in a single parallel payment:

Note: This scenario is an example only and does not take PayPal

fees into account.

Pay request.Chained Payments

A chained payment is a payment from a sender that is indirectly split among multiple

receivers. It is an extension of a typical payment from a sender to a receiver,

in which a receiver, known as the primary receiver, passes part of

the payment to other receivers, who are called secondary receivers.

Note: The API caller must get permission from PayPal to use

chained payments.

You can have at most one primary receiver and 1-5 secondary receivers. Chained payments

are useful in cases when the primary receiver acts as an agent for other receivers.

The sender deals only with the primary receiver and does not know about the secondary

receivers, including how a payment is split among receivers. The following example

shows a sender making a payment of $100:

In this example, the primary receiver receives $100 from the sender's perspective.

The primary receiver actually receives only $10 and passes a total of $90 to secondary

receivers, Receiver 2 and Receiver 3.

Note: This scenario is an example only and does not take PayPal

fees into account.

Delayed Chained Payments

By default, payments to all receivers in a chained payment are immediate. However,

you can choose to delay a payment to a secondary receiver. For example, as primary

receiver, you may require secondary receivers to perform some action, such as shipping

goods or waiting for expiration of a return period, before making payment. To complete

the payment, you must explicitly execute a payment to secondary receivers after

the sender pays you. The payment must occur within 90 days, after which you cannot

complete the payment as part of the original chained payment.

Payment Approval

The sender of a payment must approve the transfer. The sender can log in to paypal.com

to approve each payment, preapprove payments, or when the sender is your application,

be implicitly approved to make payments.

Note: Preapproval requests require permission from PayPal.

There are 3 kinds of payment approvals:

- Explicit approval payments, in which the sender logs in to paypal.com to approve

each payment. Explicitly approving payments is the traditional way to pay with PayPal.

This method is the only option unless the sender has set up a preapproval agreement

or you, the API caller, are also the sender.

- Preapproved payments, in which a sender logs in to PayPal and sets up preapprovals

that approve future payments or set up a preapproval during the embedded payment

flow. The sender logs in to paypal.com once to set up the preapproval. After the

sender agrees to the preapproval, specific approval is unnecessary.

- Implicit approval payments, in which your application is both the sender of a payment

and the caller of the Adaptive Payments

Pay API.

In this case, PayPal makes the payment from your own account, which eliminates the

need for approval.

Pay API.

In this case, PayPal makes the payment from your own account, which eliminates the

need for approval.Adaptive Payments Service Permissions

Adaptive Payments services are divided into 2 categories: standard services that

do not require specific permission to use and advanced services that

require permission from PayPal to use. You obtain permission to use a service when

you submit an application to PayPal.

You can use the following standard services without requesting specific permission:

- Making simple or parallel payments that require explicit approval of the sender

- Getting payment details

- Making refunds

- Performing currency conversions

To use any other service, you must receive permission from PayPal to use the service

when you submit your application. For example, if your application makes chained

payments, which is an advanced service, you request permission when you submit your

application. Later, if you modify your application to support preapprovals, which

is also an advanced service, you must resubmit your application to obtain permission

from PayPal to use the service.

Important: If

you allow a third party to PayPal to execute an application on your behalf, the

third party becomes the API caller because the party is now calling the Adaptive

Payments API. The third party must also have permission from PayPal to use the advanced

service. For example, if an application supports chained payments, both you and

the third party must have permission to use the service.

Important: If

you allow a third party to PayPal to execute an application on your behalf, the

third party becomes the API caller because the party is now calling the Adaptive

Payments API. The third party must also have permission from PayPal to use the advanced

service. For example, if an application supports chained payments, both you and

the third party must have permission to use the service.

Explicit Approval Payment Flow

Explicit approval payments require the sender to log in to paypal.com to approve

the payment. You control the interaction between your application and PayPal by

specifying URLs for redirection in various situations.

The following diagram shows the basic flow of control for a payment (such as payment

for items in a shopping cart at a web store) that requires the sender to log in

to paypal.com to approve the payment:

The following items correspond to the circled numbers in the diagram:

- Your site or device sends a

Pay request

to PayPal on behalf of a sender.

- PayPal responds with a key that you use when you direct the sender to PayPal.

- You redirect your sender's browser to paypal.com.

- After the sender authorizes the transfer of funds, PayPal redirects your sender's

browser to the location you specify.

Note: The cancel operation is not shown in the diagram. Cancellation

is handled by a separate cancellation URL to which PayPal redirects the sender's

browser any time the sender cancels while on paypal.com.

In addition to these steps, PayPal notifies you and the sender of the payment.

Pay request

to PayPal on behalf of a sender.Preapproved Payments Flow

Preapproved payments require the sender to log in to paypal.com to set up the payment

agreement with a particular vendor. You control the interaction between your application

and PayPal by specifying URLs for redirection in various situations.

The sender logs in to paypal.com and sets up the preapproval, which includes setting

the following information:

- duration of the preapproval, from the start date to the end date, inclusive

- the maximum amount being preapproved

- the maximum number of payments

The following diagram shows the basic flow of control during a preapproval operation:

The following items correspond to the circled numbers in the diagram:

- Your site or device sends a

Preapproval request

to PayPal on behalf of a sender.

- PayPal responds with a key, called a preapproval key, that you use

when you direct the sender to PayPal, and once the preapproval has been established,

whenever you automatically complete a payment on behalf of the sender.

- You redirect your sender's browser to PayPal.

- After the sender logs in to paypal.com and sets up the preapproval, PayPal redirects

the sender's browser to a location you specify.

Note: The cancel operation is not shown in the above diagram.

Cancellation is handled by a separate cancellation URL to which PayPal redirects

the sender's browser any time the sender cancels while on paypal.com.

In addition to the steps shown above, PayPal sends an email notifying you and the

sender that the preapproval has been created.

After the sender sets up the approval, you can make payments on the sender's behalf

directly. The sender is no longer required to log in to PayPal to complete the payment.

The following diagram shows the basic flow of control during a Pay operation:

The following items correspond to the circled numbers in the diagram:

- Your site or device sends a

Pay request

to PayPal on behalf of a sender. You can require the sender to provide a personal

identification number (PIN); however, logging in to paypal.com is no longer required.

Note: You must provide a preapproval key that identifies the

agreement.

- PayPal still responds with a payment key that you can use for other API operations,

such as for obtaining details of the payment or for issuing a refund.

Preapproval request

to PayPal on behalf of a sender.Pay operation:Pay request

to PayPal on behalf of a sender. You can require the sender to provide a personal

identification number (PIN); however, logging in to paypal.com is no longer required.

Note: You must provide a preapproval key that identifies the

agreement.

Implicit Approval Payments Flow

Implicit approval payments are payments where the sender and the API caller are

using the same account. Because PayPal draws the funds for the payment from your

own account, there is no approval necessary, and as such there is no visible flow

for implicit approval payments.

The following diagram shows the basic flow of control during an implicitly approved

payment operation:

The following items correspond to the circled numbers in the diagram:

- Your site or device sends a

Pay request

to PayPal.

Note: A web flow is not required.

- PayPal responds with a key that you use for other API operations.

Pay request

to PayPal.

Note: A web flow is not required.

Embedded Payments

An embedded payment is a payment that initiates a visual presentation

of the Adaptive Payments payment flow in which the sender appears to never leave

your checkout or payment page. Embedded payments make it easier for a sender to

make a payment because PayPal may allow the sender to bypass the PayPal login step.

The ability to bypass the login relies on a remember

me cookie, which is stored in the sender's browser when the sender

chooses to take advantage of being remembered. Opting in reduces the number of steps

to purchase goods or services without significantly increasing the risk that the

sender's account might be misused. After the initial login, PayPal bypasses the

login step if subsequent payments meet specific criteria, such as a subsequent payment

for a small amount.

Embedded Payment Flow Presentations

PayPal provides the following kinds of visual presentations for the embedded payment

flow:

- The payment flow can be embedded as a lightbox on your web page, which gives the

impression that the payment is handled completely within your website:

- The payment flow can appear in a minibrowser window that appears in front of your

web page, which does not require an IFRAME:

- The payment flow can be embedded as a lightbox in an IFRAME on your web page, which

gives the impression that the payment is handled completely within your website:

You choose your preferred visual presentation when you invoke the embedded payment

flow. In some cases, PayPal may override your choice to use a lightbox; for example,

when the sender is required to log into PayPal for the initial payment.

Kinds of Embedded Payments

Embedded payments can include

- simple payments

- parallel payments

- chained payments

You can also enable preapprovals for future payments or enable shipping addresses

to be associated with embedded payments.

Important: Payments

for digital goods must use the embedded payment flow. You cannot associate a preapproval

for future payments or enable shipping addresses in a payment for digital goods.

Important: Payments

for digital goods must use the embedded payment flow. You cannot associate a preapproval

for future payments or enable shipping addresses in a payment for digital goods.

Embedded Payments Implementation Basics

To implement the embedded payment flow, you must

- include JavaScript code from PayPal on your checkout or payment web pages

- use the functions provided in the JavaScript to coordinate the PayPal flow with

the appearance of your web pages

- launch your preferred embedded payment flow, which is either the lightbox or minibrowser,

and redirect the sender's browser to the PayPal URL that supports embedded payments,

which is

https://www.paypal.com/webapps/adaptivepayment/flow/pay?paykey=...

You must call the Pay API

operation to obtain a payment key before launching the embedded payment flow. If

the payment is specifically for digital goods, modify your Pay API

operation to specify that each receiver is receiving payment for digital goods.

https://www.paypal.com/webapps/adaptivepayment/flow/pay?paykey=...Pay API

operation to obtain a payment key before launching the embedded payment flow. If

the payment is specifically for digital goods, modify your Pay API

operation to specify that each receiver is receiving payment for digital goods.Embedded Payment Experience

To the sender of a payment, the embedded payment experience appears to be built

into your website. The PayPal-supplied JavaScript provides all the code needed to

set up the flow as an IFRAME within the sender's browser and as a pop-up mini-browser

that appears in front of your website. Typically, the sender initiates a payment

by clicking a button:

PayPal responds to the JavaScript that initiates the flow. If it is the first payment,

or if PayPal determines that the payment requires the sender to log in, PayPal displays

a Log In button in the IFRAME created by the JavaScript:

The IFRAME also allows the sender to sign up for a PayPal account or pay as a guest

without logging in.

Note: Guest checkout only provides the visual benefits of

an embedded payment. It does not reduce the payment steps.

After clicking Log In, PayPal displays a Log in to your PayPal account page

in the minibrowser. The sender enters an email address and password and can also

check a box, which allows the sender to skip this step for subsequent purchases:

The checkbox controls the remember me behavior

for log in. This behavior allows the sender to skip the log in step in cases where

there is little risk of the account being misused.

Important: Opting

in to the remember me behavior

does not guarantee that the sender will not be asked to provide log in credentials.

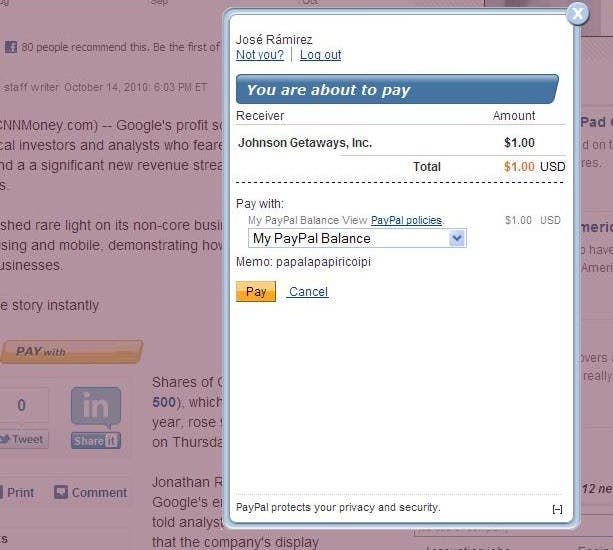

After logging in, PayPal displays the You are about to pay page,

sometimes called the review your payment page

in the minibrowser:

Important: Opting

in to the remember me behavior

does not guarantee that the sender will not be asked to provide log in credentials.

After logging in, PayPal displays the You are about to pay page,

sometimes called the review your payment page

in the minibrowser:

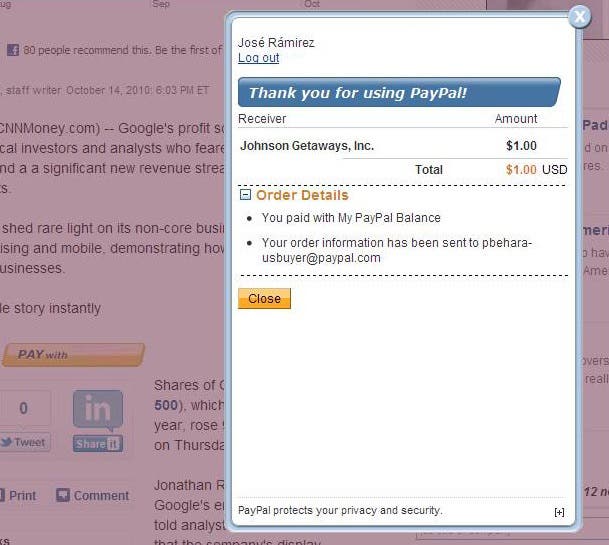

If the sender chooses Cancel, PayPal redirects the sender's browser

to the cancel URL specified in the Pay API operation's request message. If the sender

chooses Pay, the Thank you for using PayPal page

appears in the minibrowser:

When the sender clicks Close, PayPal redirects the sender's browser

to the return URL specified in the Pay API operation's request message.

Note: You are responsible for closing the minibrowser after

PayPal redirects to the page specified in either the return or cancel URL. PayPal

provides a JavaScript function that you call to close a PayPal minibrowser or lightbox.

For subsequent payments in which PayPal does not require the account holder to log

in again and the account holder has chosen to be remembered, the PayPal payment

pages appear in a lightbox rather than in a minibrowser and PayPal bypasses the

log in steps. For these payments, the actions you take to launch the flow and close

the lightbox, remain the same. For example, the lightbox for reviewing a payment

would appear in your page as follows:

The lightbox containing the confirmation would appear in your page as follows:

Preapprove Future Payments Checkbox

You can add a Preapprove future payments checkbox to the sender's

embedded payment experience, which enables the sender to preapprove subsequent payments.

If you specify both a payment key and a preapproval key when you call the Pay API

operation, PayPal displays the checkbox on the payment page in the minibrowser:

If the payment sender checks the preapproval box, the confirmation page provides

details about the preapproval:

Note: Unless there is an error with the payment itself, PayPal

transfers the money regardless of whether the preapproval for future payments was

successful.

Note: Unless there is an error with the payment itself, PayPal

transfers the money regardless of whether the preapproval for future payments was

successful.

Pay API

operation, PayPal displays the checkbox on the payment page in the minibrowser:

Shipping Address Information

You can display and collect shipping address information. PayPal displays the default

shipping address when you setsenderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions:

The sender of a payment can select one of the available shipping addresses or add

a new shipping address by selecting Add new shipping address from

the Ship to: drop-down menu:

senderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions:Embedded Payment Experience

To the sender of a payment, the embedded payment experience appears to be built

into your website. The PayPal-supplied JavaScript provides all the code needed to

set up the flow as an IFRAME within the sender's browser and as a pop-up mini-browser

that appears in front of your website.

Typically, the sender initiates a payment by clicking a button:

PayPal responds to the JavaScript that initiates the flow. If it is the first payment,

or if PayPal determines that the payment requires the sender to log in, PayPal displays

a Log In button in the IFRAME created by the JavaScript:

The IFRAME also allows the sender to sign up for a PayPal account or pay as a guest

without logging in.

Note: Guest checkout only provides the visual benefits of

an embedded payment. It does not reduce the payment steps.

After clicking Log In, PayPal displays a Log in to your PayPal account page

in the minibrowser. The sender enters an email address and password and can also

check a box, which allows the sender to skip this step for subsequent purchases:

The checkbox controls the remember me behavior

for log in. This behavior allows the sender to skip the log in step in cases where

there is little risk of the account being misused.

Important: Opting

in to the remember me behavior does not guarantee that the sender will not be asked

to provide log in credentials.

After logging in, PayPal displays the You are about to pay page,

sometimes called the review your payment page in the minibrowser:

Important: Opting

in to the remember me behavior does not guarantee that the sender will not be asked

to provide log in credentials.

After logging in, PayPal displays the You are about to pay page,

sometimes called the review your payment page in the minibrowser:

If the sender chooses Cancel, PayPal redirects the sender's browser

to the cancel URL specified in the Pay API operation's request message. If the sender

chooses Pay, the Thank you for using PayPal page

appears in the minibrowser:

When the sender clicks Close, PayPal redirects the sender's browser

to the return URL specified in the Pay API operation's request message.

Note: You are responsible for closing the minibrowser after

PayPal redirects to the page specified in either the return or cancel URL. PayPal

provides a JavaScript function that you call to close a PayPal minibrowser or lightbox.

For subsequent payments in which PayPal does not require the account holder to log

in again and the account holder has chosen to be remembered, PayPal bypasses the

log in steps.

For example, the lightbox for reviewing a payment would appear in your page as follows:

The lightbox containing the confirmation would appear in your page as follows:

The actions you take to launch the flow and close the lightbox are the same steps

you take for the minibrowser.

Preapprove Future Payments Checkbox

You can add a Preapprove future payments checkbox to the sender's

embedded payment experience, which enables the sender to preapprove subsequent payments.

If you invoke the embedded payment flow, passing both a payment key obtained by

calling Pay and

a preapproval key obtained by callingPreapproval,

PayPal displays the checkbox on the payment page:

If the payment sender checks the preapproval box, the confirmation page provides

details about the preapproval:

Note: Unless there is an error with the payment itself, PayPal

transfers the money regardless of whether the preapproval for future payments was

successful.

Pay and

a preapproval key obtained by callingPreapproval,

PayPal displays the checkbox on the payment page:Embedded Preapproval Experience

Adaptive Payments provides a preapproval experience using a mini-browser.You can

invoke the embedded preapproval flow by passing the preapproval key. Here is an

example :

https://www.paypal.com/webapps/adaptivepayment/flow/preapproval?preapprovalKey

=PA-xxxxxxxxxxxx&expType=mini

PayPal first asks the user to log into their PayPal account:

After signing in, the user is presented with a consent form that the user must agree

to:

If the seller has enabled PIN code entry, after consenting to the agreement,

the

user is prompted to enter a PIN code by the seller:

Finally, the user is presented with a confirmation screen:

the user is prompted to enter a PIN code by the seller:

Shipping Address Selection

You can display and collect shipping address information for a transaction with

the embedded payment flow. PayPal displays the default shipping address when you

set senderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions:

The sender of a payment can select one of the available shipping addresses or add

a new shipping address by selecting Add new shipping address from

the Ship to: drop-down menu:

After the sender of the payment clicks Pay, PayPal displays the selected

shipping address on the Thank you for using PayPal page:

You can call the GetShippingAddresses API

operation to obtain the selected shipping address for the transaction using the

key assoicated with the payment.

senderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions:GetShippingAddresses API

operation to obtain the selected shipping address for the transaction using the

key assoicated with the payment.Setting Up Web Pages to Invoke the Embedded Payment Flow Using a Lightbox

Use the JavaScript functions in https://www.paypalobjects.com/js/external/dg.js to

set up and control the embedded payment flow. This example shows how to initiate

the embedded payment flow after obtaining a payment key.

This example assumes that you obtain a payment key before initiating the flow and

that the key does not change or expire before the sender completes the flow.

To set up a web page to invoke the embedded payment flow:

On the pages you identify as the return and cancel URLs in the Pay API

operation, you must include the PayPal JavaScript functions from dg.js and

close the PayPal window, as in the following example:

dgFlow = top.dgFlow || top.opener.top.dgFlow;

dgFlow.closeFlow();

top.close();

https://www.paypalobjects.com/js/external/dg.js to

set up and control the embedded payment flow. This example shows how to initiate

the embedded payment flow after obtaining a payment key.Pay API

operation, you must include the PayPal JavaScript functions from dg.js and

close the PayPal window, as in the following example:Setting Up Web Pages to Invoke the Embedded Payment Flow Using a Minibrowser

Use the JavaScript functions in https://www.paypalobjects.com/js/external/apdg.js to

set up and control the embedded payment flow. This example shows how to initiate

the embedded payment flow after obtaining a payment key.

This example assumes that you obtain a payment key before initiating the flow and

that the key does not change or expire before the sender completes the flow.

To set up a web page to invoke the embedded payment flow:

The following minibrowser return script can be used to determine whether the payment

successfully completed:

PAYMENTDETAILS=$(wget --output-document=- \

--quiet \

--header="X-PAYPAL-SERVICE-VERSION: 1.0.0" \

--header="X-PAYPAL-SECURITY-USERID: $APIUSER" \

--header="X-PAYPAL-SECURITY-PASSWORD: $APIPASS" \

--header="X-PAYPAL-SECURITY-SIGNATURE: $APISIG" \

--header="X-PAYPAL-REQUEST-DATA-FORMAT: NV" \

--header="X-PAYPAL-RESPONSE-DATA-FORMAT: NV" \

--header="X-PAYPAL-APPLICATION-ID: $APPLICATIONID" \

--post-data="payKey=$PAYKEY&requestEnvelope.errorLanguage=en_US" \

https://www.paypal.com/AdaptivePayments/PaymentDetails)

if echo $PAYMENTDETAILS | grep -q "\&status=COMPLETED"

then echo "Thank you for approving pay key $PAYKEY"

else echo "Sorry, you were unable to approve pay key $PAYKEY. Please try another transaction!"

fi

https://www.paypalobjects.com/js/external/apdg.js to

set up and control the embedded payment flow. This example shows how to initiate

the embedded payment flow after obtaining a payment key.Displaying and Collecting Shipping Addresses

PayPal displays the default shipping address and allows the payment sender to change

the address when you setsenderOptions.requireShippingAddressSelection to true in

your request to the SetPaymentOptions API

operation. You call theGetShippingAddresses API

operation to obtain the selected shipping address after invoking the embedded payment

flow.

The steps in this example assume that you have implemented the JavaScript for invoking

the embedded payment flow, that you have set up your button or form to invoke the

flow, and that you have included the code to close the window associated with the

flow.

To display and collect the selected shipping address

- Call the

Pay API

operation with actionType set

to CREATE to

obtain a payment key.

- Set

senderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions and

call the API operation.

- Redirect the payment sender's browser to the embedded payment flow at

https://www.paypal.com/webapps/adaptivepayment/flow/pay?paykey=...after

obtaining the pay key.

- After returning from the flow, call the

GetShippingAddresses API

operation to obtain the selected shipping address.

senderOptions.requireShippingAddressSelection to true in

your request to the SetPaymentOptions API

operation. You call theGetShippingAddresses API

operation to obtain the selected shipping address after invoking the embedded payment

flow.Pay API

operation with actionType set

to CREATE to

obtain a payment key.senderOptions.requireShippingAddressSelection to true in

your request to SetPaymentOptions and

call the API operation.https://www.paypal.com/webapps/adaptivepayment/flow/pay?paykey=...after

obtaining the pay key.GetShippingAddresses API

operation to obtain the selected shipping address.Guest Payments

Adaptive payments supports guest payments, which are payments using

a sender's credit card without logging into PayPal to complete the transaction.The

sender is not explicitly identified as a PayPal account holder during the transaction

and is not required to have a PayPal account.

Each receiver of a guest payment must be a verified PayPal Business Verified or

Premier Verified account holder.

PayPal handles guest payments in the same way that it handles explicitly approved

payments. Instead of logging into PayPal to complete transaction, the sender provides

credit card information on the PayPal payment screen:

Note: For European Union countries, only 10 guest payments

are allowed per card.

Fee Payment Configuration

You can set up a payment transaction so that either the sender of a payment pays

the fee or the receivers of a payment pay the fee. If receivers pay the fee, you

can specify whether the primary receiver in a chained payment pays the entire fee

or whether all receivers pay a portion of the fee.

You can specify who pays these fees. Fee payment configurations include:

- Sender Pays the Fee

- Receiver Pays the Fee in

a Parallel Payment

- Each Receiver Pays the Fee

in a Chained Payment

- Primary Receiver Pays the

Fee in a Chained Payment

Note: Fees are determined by PayPal and are based on criteria,

such as the transaction volume of the receiver. In the examples that follow, the

fees shown are representative only and not actual fees.

Sender Pays the Fee

The sender can pay a fee for a simple payment, parallel payment, or a chained payment.

The following example shows fees being paid by the sender of a parallel payment,

based on the assessment for each receiver:

In this example, the sender pays a total of $510.83, which includes all fees.

Note: The scenario above is an example only and is not representative

of actual PayPal fees.

Receiver Pays the Fee in a Parallel Payment

If the receivers pay the fee in a parallel payment, each receiver pays a portion

of the fee, based on their assessment. The following example shows the receivers

paying the fees:

Note: The scenario above is an example only and is not representative

of actual PayPal fees.

Each Receiver Pays the Fee in a Chained Payment

If the receivers pay the fee in a chained payment, each receiver pays a portion

of the fee, based on their assessment. The following example shows the receivers

paying the fees:

In this example, the primary receiver, identified as the merchant, pays a fee for

$20 received. Each of the other receivers also pay a fee on the amount each receives.

Note: The scenario above is an example only and is not representative

of actual PayPal fees.

Primary Receiver Pays the Fee in a Chained Payment

If only the primary receiver pays the fee in a chained payment, other receivers

pay no fees. The fees paid by the primary receiver, however, are based upon the

total fees assigned to all receivers. The following example shows only the primary

receiver, identified as the merchant, paying all fees:

Note: The scenario above is an example only and is not representative

of actual PayPal fees.

Click here to view normal PayPal integration

Click here to view normal PayPal Pro integration

Note: The scenario above is an example only and is not representative

of actual PayPal fees.

Click here to view normal PayPal Pro integration

By, Akash Roy, CEO, JPR Infoserve, http://jprinfoserve.com

No comments:

Post a Comment